washington state capital gains tax 2022

The Washington Repeal Capital Gains Tax Initiative is not on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. On May 4 Washington state enacted a new capital gains tax equal to 7 of a residents adjusted long-term capital gains which is effective January 1 2022.

Is There A 7 Washington State Capital Gains Tax Michael Ryan Money

We have previously reported on the initial victory in our challenge to Washingtons capital gains tax.

. The capital gains tax will be paid by individuals including Washington residents and others who sell tangible assets that are located in the state. The measure adds a 7 tax on. 2 2022 GeekWire Summit 2022 recap.

The capital gains tax and the. On Tuesday March 1 2022 Washington State Superior Court Judge Brian Huber released a ruling striking down the states new capital gains tax. The new law will.

In March of 2022 the Douglas County Superior Court ruled in Quinn v. The future of Washington states capital gains tax is in the hands of state Supreme Court. The Washington State Superior Court on March 1 2022 overturned a new law enacted last year to tax capital assets.

FAQs in May 2022. Week in Review. 5096 which was signed by Governor Inslee on May 4 2021.

State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. July 13 2022. Most popular stories on GeekWire for the week of Oct.

The capital gains tax took effect on January. The Washington Legislature passed Senate Bill 5096 on April 25 2021 the last day of the 2021 Washington legislative session. 5096 which was signed by Governor Inslee on May 4 2021.

State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements. While it technically takes effect at the start of 2022 it wont officially. Individuals who own certain.

Committee Information Registration December 10 2021 Treasurer Heather Clarke 3400 Capitol Blvd SE Suite 202. The Washington Capital Gains Tax Changes Initiative 1934-1938 is not on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8. The new law will.

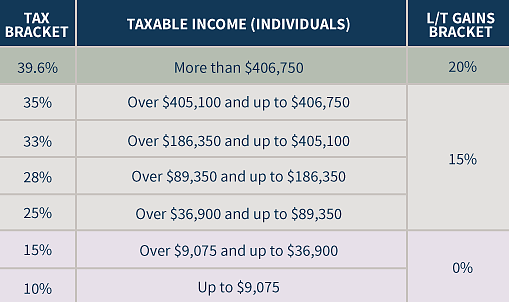

Repeal the Capital Gains Income Tax - 2022. Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB. Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20.

In Washington State 2022 brings the scheduled implementation of two new taxes that have the potential to impact many Merriman clients. Washington farmers and ranchers wont know whether the state will tax 2022 capital gains until next year and maybe not even by the date the taxes were to be due. Tech and civic leaders share insights and vision for the future.

Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB. Short-term gains are taxed as ordinary income based. Capital assets are defined as property that is held for investment or.

By Mike Lewis on July 12 2022 at 446 pm July 13 2022 at. Washington Capital Gains Tax. Last year the Legislature passed and Gov.

The Washington State Supreme Court today expedited the ultimate resolution of the Freedom Foundations lawsuit challenging the capital gains income tax bill. 2022 this new tax. As of 2022 the long-term capital gains tax rate in Washington state for personal property is pending at 7.

SB 5096 is a state capital gains tax on. Given the legal facts the state supreme court should reject the latest attempt to circumvent the will of the people as clearly expressed in the constitution and at the ballot box. The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year.

Jay Inslee signed into law a capital-gains tax aimed at the states wealthiest residents.

Foes Of State S Capital Gains Tax Drop Plans For Initiative Issaquah Reporter

Mcdermott Will Emery On Twitter In Washington State A Douglas County Superior Court Judge Agreed With Opponents Of A New Capital Gains Tax Troy Van Dongen Has Details Https T Co Kzoroii4zk Https T Co Lbimpkophd

The Turbulent Ride For Washington S New Capital Gains Tax Continues The New Tax Regime Took Another Hit But This Setback Came Outside Of The Courts Larry S Tax Law

Rules For Washington S New Tax Unsettled Pending State Supreme Court Decision Washington Capitalpress Com

How Do State And Local Individual Income Taxes Work Tax Policy Center

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Is There A 7 Washington State Capital Gains Tax Michael Ryan Money

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

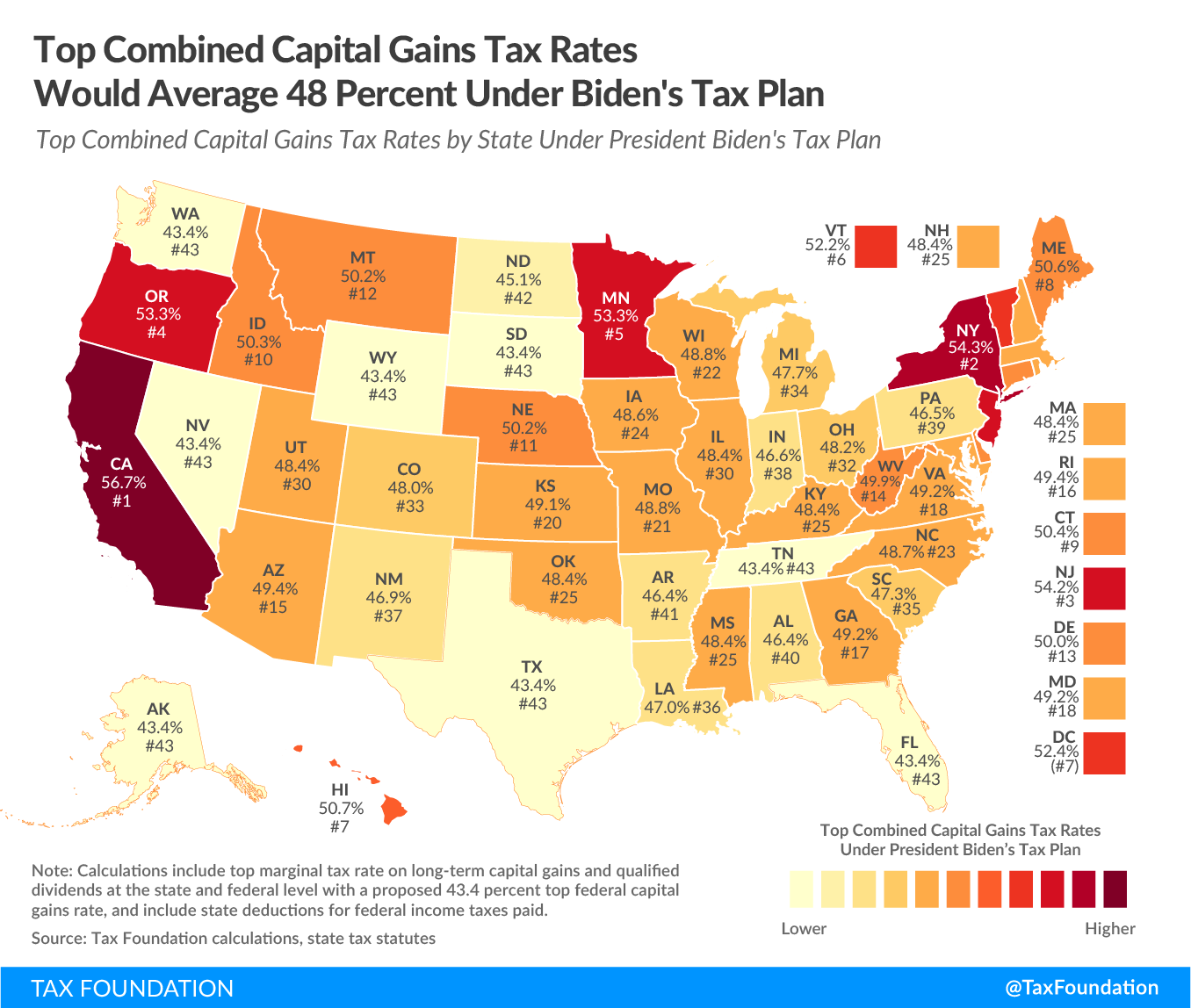

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

New Washington State Laws Going Into Effect In 2022

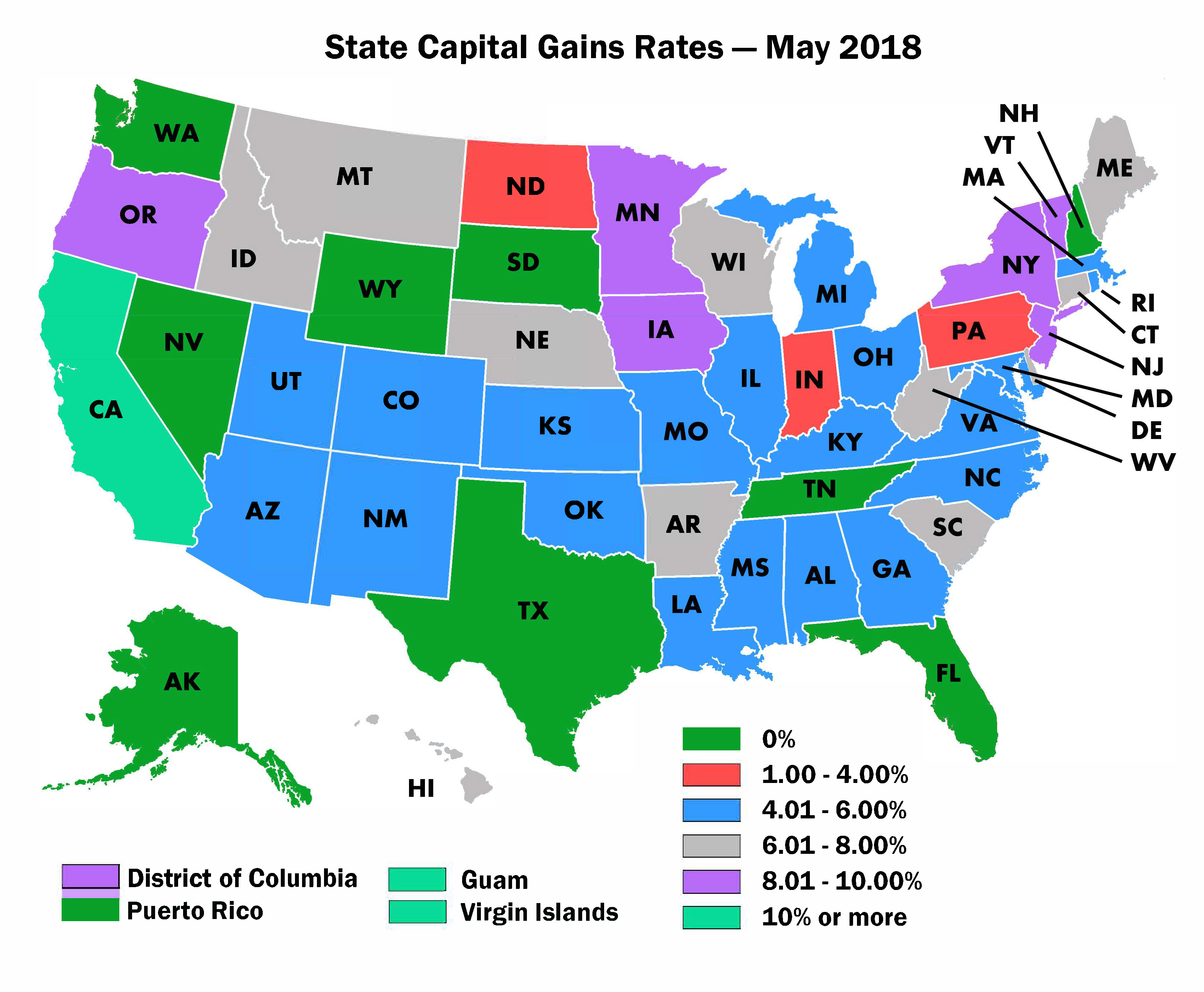

2022 Capital Gains Tax Rates By State Smartasset

Washington Court Finds Capital Gains Tax Unconstitutional

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Washington Judge Overturns State S New Capital Gains Tax King5 Com

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Washington Supreme Court To Hear Challenge To New Capital Gains Tax Bypassing Court Of Appeals The Seattle Times

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation